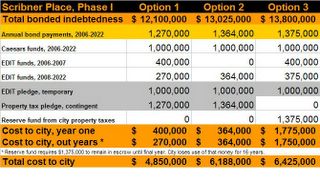

Mayor Garner's administration, in a mysterious concession to the demonstrated ignorance of certain members of New Albany's city council, presented three options for the financing of the redevelopment project known as Scribner Place, Phase I, at the council's June 16 work session that preceded the council's regular bi-monthly meeting.

Gary Malone of H.J. Umbaugh & Associates, advisor to the city for the purpose of preparing to authorize the issuance of bonded indebtedness, made the presentation, which included easily understandable charts and diagrams of the three options.

Having no access to the document presented to accredited members of the press and to each member of the council who was present, I am offering this record from my notes as compiled contemporaneously to the presentation and aided by a slight ability to read over the shoulder of members of the audience who possessed copies of the document.

The bond issue decision will first come to council with the July 7, 2005 meeting. Here are the options presented.

The cost of the project, if it proceeds NOW and on schedule, is $13,261,000.

Construction costs = $8,000,000

Non-constructions costs = $2,800,000

Capitalized interest = $1,300,000

(this is the cost of borrowed money during the approximate 2-year buildout)Contingencies and the fees associated with arranging the financing make up the remainder of the $13,261,000.

OPTION 1The actual bonded indebtedness under this option (called lease rental bonds), or the amount to be borrowed, would be $12,100,000.

The city would continue to commit $400,000 each year for the next two years.

An additional $361,000 in money from the Caesars Foundation of Floyd County remains from the initial $1 million grant.

This totals up to $13,261,000.

Repayment of the bonds would be made through these revenue streams:

$1,000,000 each year from Caesars/Harrah's

$270,000 each year after '07, for a total annual lease payment (bond retirement) of $1,270,000.

Each year, while awaiting the payment from Caesars, the city would be obliged to pledge $1 million from EDIT (Economic Development Income Tax) funds. Once the payment is received, those EDIT funds would be freed for any lawful purpose the city determines. This is required under all scenarios. Caesars is paying the city. The city has to promise to devote that money to the bond repayment. Only if Caesars/Harrah's reneges on its commitment, which Mr. Seabrook and Mr. Schmidt assure us won't happen, would the city be obligated to expend that $1 million for bond retirement.

As an additional credit enhancement (a safety measure for the buyers of the bonds that would make them feel more comfortable in buying them, and thus willing to take a lower interest rate), the city would have to pledge to repay the bonds from the first available dollars generated by the property tax. As I understand it, the buyers of the bonds want to know that in the extremely unlikely event that Caesars reneges AND the city can't come up with $1,270,000 from the approximately $2.4 million it currently collects from the income tax, that the city will pay what it owes. It is the taxing authority that the city is promising to use in an extreme case. This has NOTHING to do with raising anyone's taxes.

Failure to pledge that the city will pay the bonds from property tax resources (and it will never get to that point, since we have Caesars and then more than $2 million in unpledged EDIT funds to cover the $1,270,000) before it makes other expenditures will result in the city paying a higher interest rate - about 20-25 basis points higher, or .2-.25% more in interest (compounded) on every borrowed dollar. For example, if the city can borrow at 4% with the property tax pledge, it would pay 4.2-4.25% without that pledge. Not to mention, raising the suspicions of every lender and bond buyer in the country.

On $12,100,000 in bond principal over 17 years, that .2-.25% will eat us alive, making the painless pledge of property taxes a no-brainer. Yet, several council members have stated that they will not make the pledge. See the numbers in OPTION 3.

OPTION 2Instead of $12,100,000 in bonds issued, the city would issue $13,025,000 in bonds and skip the annual EDIT payments of $400,000 each of the next two years. This EDIT money could be used for other purposes, despite the fact that it has been committed to Scribner Place all along. In fact, $700,000 had been planned as the EDIT contribution. The mayor has found a way to reduce the annual commitment of EDIT funds to only $270,000 a year under OPTION 1, but this option forces the city to cough up $364,000 each year from EDIT funds for the final 15 years (post-construction) of the bond. To keep it that low, the city would still have to pledge its property taxing authority as a backup - that is, to continue to enhance the attractiveness of these bonds to the market of bond buyers.

OPTION 2 has us borrowing almost $1 million more, spending almost $100,000 more each year, but lets us spend like we're RICH for the next two years.

OPTION 3Under this option, we borrow $13,800,000. We continue to pay $400,000 a year during '06 and '07, and then spend $375,000 each year thereafter from EDIT funds.

ADDENDUM: OPTION 3 would also require the city to fund a debt service reserve fund to the tune of approximately $1,375,000 for the term of the bonds (locking the final year's payment in a vault where we can't touch it).This is the option where we announce to the world that, no matter how unlikely it is that it would be called upon, this city won't pledge its property taxing authority to back up the bonds. We announce that while we want buyers to buy our bonds and trust us (really!), we know they won't trust us as much and we're willing to penalize ourselves by paying a higher interest rate for the next two decades. In other words, we tell the world "We're stoopid!"

OPTION 4The magical plan where a strong but tiny non-profit agency tries to borrow money, but has to pay a much higher interest rate, thus turning its Y into a much lesser facility, and creating a much more expensive swimming and recreation facility that city residents have to pay a much higher membership rate for. Oh yeah. And one where the city sends a signal that mirrors the Hon. Dan Coffey's brilliant civic boosterism message from today's C-J:

"(Coffey)...said he doubts Scribner Place will attract the kinds of private development Messer, Garner and some others expect.

"He said he doesn't think the market exists in downtown New Albany for such private development at this time."

That's right, Coffey is driving investment AWAY from his council district and from his acolyte Steve Price's adjacent district. Thank you, Mr. Coffey and Mr. Price.

Woo-hoo for the Cappuccino Effect.

Option 3 costs the city $1.7 million more than option 1. End of analysis. Please join our class action suit if you think that's the most moronic idea you ever heard, if you think it borders on criminal negligence to put the city in hock an additional and unnecessary $1.7 million, if you wonder what would induce a council member to handcuff the city so stringently just because some foolish or ignorant constituents are confused, if you think it is the responsibility of elected leaders to explain the facts and tell the truth to their constituents.No sane person, no sincere person has any reason to equate the pledge with the tax. The pledge is our promise to pay, which we will do in any case. Property taxes don't go up unless you SPEND them unwisely or elect to add new services or lose sources of money. The pledge, if anything, will LOWER our property taxes.But just wait...when our taxes do go up because of inflation or because the state has pushed the cost of services onto the city and said "you face the voters who are demanding services and you pay for it," some yahoo (or possibly yahooette) will scream "Scribner Place raised our taxes."-------------------------------------Randy Smith, destinations@sbcglobal.net